Investor value creation, utility stock prices and clean energy policy

If regulators want to steer utility investment toward renewable, sustainable resources, and away from carbon-emitting types, they can apply basic investor value creation concepts when implementing policy. The key consideration is the size of the gap between two rates of return: (1) the profit rate utilities earn, and (2) the minimum threshold return that investors require. As a general proposition, holding the scale of the investment options constant, utilities will create the most investor value if they invest in the project that has the largest positive gap between those two returns (profit rate – minimum return). To guide utilities in a particular direction, regulators could expand this return gap for desirable resources and compress it for resources that do not meet public policy objectives.1

This suggests that there is more to investor value than profit, and there is. While many of us learned about simple profit-maximizing behavior in introductory economics courses, we won’t find a recommendation to proceed along those lines in corporate finance texts, as shown in this quote:

Profit maximization doesn’t make sense as a corporate objective.2

Profit maximization works as a proper corporate goal only under stylized conditions, one of which is that no new capital investment will be made, a condition that clearly does not apply to utilities.3

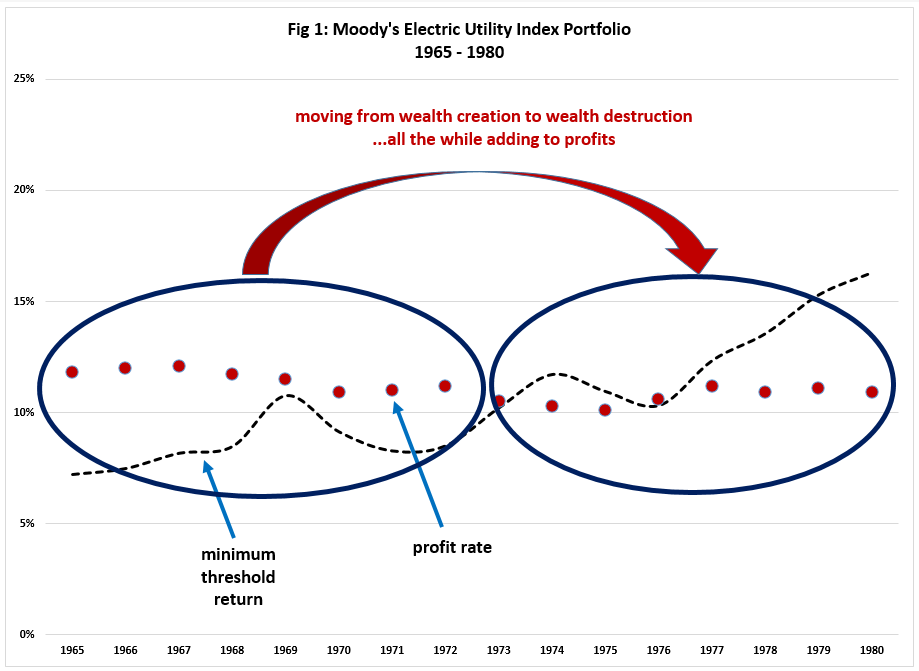

If a company invests in a project with a long-term profit rate less than zero, investor wealth suffers, right? That should be obvious. Yet, what is less obvious is that some profitable investments also can be a bad deal for the investor. Electric utility history bears this out. Figure 1 shows the profit rate and the minimum threshold return for the Moody’s Electric Utility Stock Index, a portfolio of 24 large-cap utility stocks. The period under review is 1965 to 1980. Examining the long-term trends, we see a fairly constant profit rate and an increasing minimum return threshold. If profitability was the only factor of interest, utilities would have been fine. But they were not and finance principles tell us why.

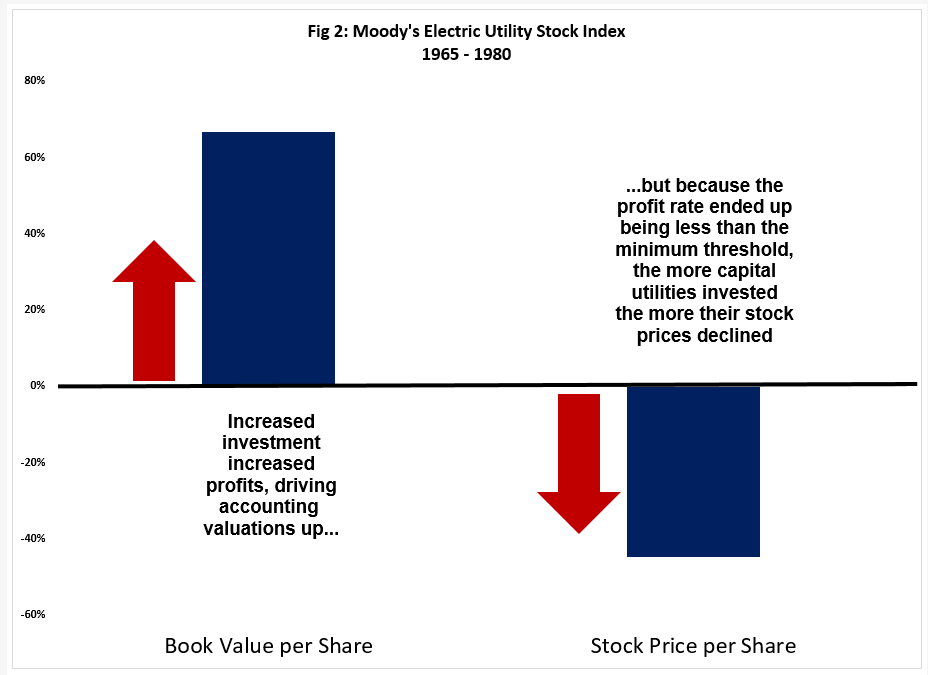

Investing more capital in profitable assets led to higher accounting-based utility valuations. See Figure 2. Nevertheless, since the gap between the profit rate and the minimum threshold return went from positive to negative, and since investment in the later period happened to be particularly heavy, it ultimately destroyed investor value, even though it increased profits. Over the entire 15-year period, the utilities’ 75% increase in profit-driven per-share accounting value was accompanied by a 45% loss in market-based stock prices. See Figure 2. This was a challenging period for non-utility companies as well, but the general market value trend was up, not down over this period (the S&P 500 Index was up by only 46%).

We can drill down one more level to show that finance principles hold at both the micro and macro levels. If finance principles are correct, the utilities that invested the most capital over this period, and that in turn had the highest profit growth rates, should have seen the greatest stock price declines, which is precisely what happened.4

The same principles that determined investor value 40 years ago still hold today. Yet, today utilities that invest relatively more capital tend to create both more profits and more investor wealth than do those with more limited capital expansion. If you’ve been following the logic here, you should be able to determine why that holds. It is not because utility investment today is more profitable than it was in the past. It is less profitable. Utility profit rates in the 1965 to 1980 period averaged 11%; today the average is about 10%. This lower profit rate can create value today because it lies above today’s minimum threshold return.

Some leading institutional economists suggested that as a general rule having a profit rate above a minimum threshold represents good public policy.5 I concur, as long as the minimum threshold return is estimated using finance principles.6 As Alfred Kahn noted, we want utilities to have an incentive to participate in the dynamic progress of the economy.7 Consistently setting the profit rate at the minimum level eliminates the incentive for utilities to invest in anything. Policy makers can use ideas set forth here to create incentives for utilities to invest, but in a nuanced way, applying higher rates of return to more-desirable resources and lower returns to less-desirable ones.8 This creates a larger return gap for the former and a smaller return gap for the latter, making the more-desirable resources more financially attractive to utilities.

Readers interested in a more thorough exposition of how finance concepts can guide regulators in this manner should see the article that appears in the Journal of Applied Corporate Finance that I co-authored with my colleagues at Lawrence Berkeley National Laboratory and Arizona State University. https://www.seventhwave.org/sites/default/files/corporate-finance2018.pdf

Other related reading: Regulatory Incentives and Disincentives for Utility Investments in Grid Modernization

Steve Kihm is Principal and Chief Economist at Slipstream and Senior Fellow in Finance at Michigan State University’s Institute of Public Utilities. He is a Chartered Financial Analyst.

1Both the profit rate and the minimum return can vary not only from utility to utility, but also from project to project within a particular utility.

2Brealey, R., S. C. Myers, and F. Allen, 2006, Principles of Corporate Finance, (New York, NY: McGraw-Hill Irwin).

3Poitras, G. 1994. Shareholder wealth maximization, business ethics and social responsibility. Journal of Business Ethics, 13, 125-134.

4Jones, R. C., 1990. Designing factor models for different types of stock: What’s good for the goose ain’t always good for the gander. Financial Analysts Journal, 46, 25-30.

5Phillips, C. 1988. The Regulation of Public Utilities, (Arlington, VA: Public Utility Reports).

6For example, the minimum acceptable return should reflect only the firm’s sensitivity to economy-wide systematic risks.

7Kahn, A. 1988. The Economics of Regulation, (Cambridge, MA: MIT Press).

8Regulators can also affect the gap by implementing policies that affect the investors’ minimum acceptable return, a discussion which is beyond the scope of this introductory post.