Financing arrows in the decarbonization quiver

We need to rapidly scale deep energy retrofits to meet U.S. and global climate goals at a pace of 2.5% per year to reach net zero emissions by 2050. That's 3.5 million retrofits per year, which far exceeds our current retrofit rate.

Utilities, state and local governments, public service organizations, and other private and public entities have the power to accelerate this goal. How?

With financing and incentive programs that level the playing field and make technologies for decarbonization more feasible for people and businesses to adopt.

These four common program models are often used to finance energy upgrades. But which one will drive the most impact? Which models are most accessible? And most importantly, which model will work best for your market?

| Model type | Description | |

|---|---|---|

| Direct bill/off bill loans | ⤐ | Unsecured consumer loan for energy upgrade; paid back over time through direct bill that is not attached to a utility account. |

| On bill financing | ⤐ | Unsecured consumer loan for energy upgrade; paid back over time through charge on utility bill. Some programs have an energy bill neutrality requirement to ensure that savings from the energy upgrade are larger than the expected monthly payment. |

| Tariffed on bill financing (TOB) | ⤐ | Utility invests in upgrade at customer’s home. The utility recovers their investment over time through fixed monthly tariffed charge on customer bill; the consumer does not take on the debt, and upgrades stay with the property. |

| Pay As You Save® (PAYS®) | ⤐ | A program model for TOB that has defined program design requirements and consumer protections, including the requirement that annual payments cannot exceed 80% of estimated annual savings. The consumer does not take on the debt, and upgrades stay with the property. |

We recommend that you consider six factors to determine which financing arrow to pull out of your quiver:

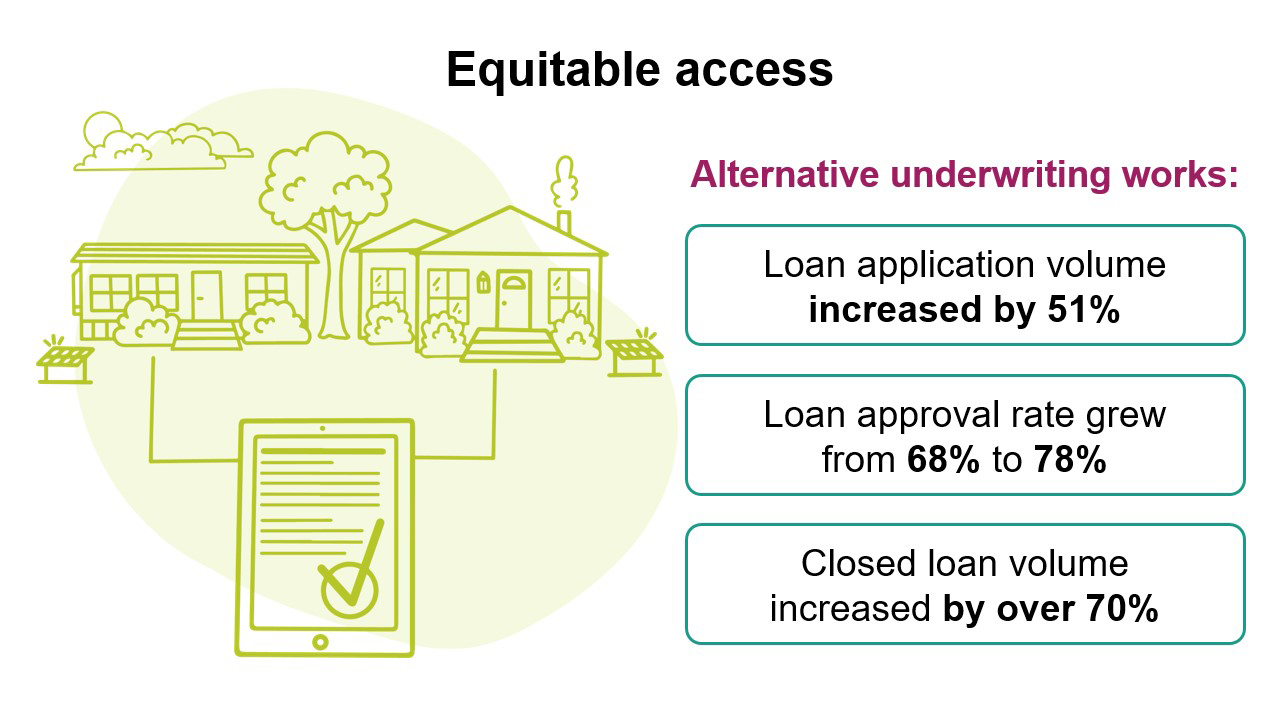

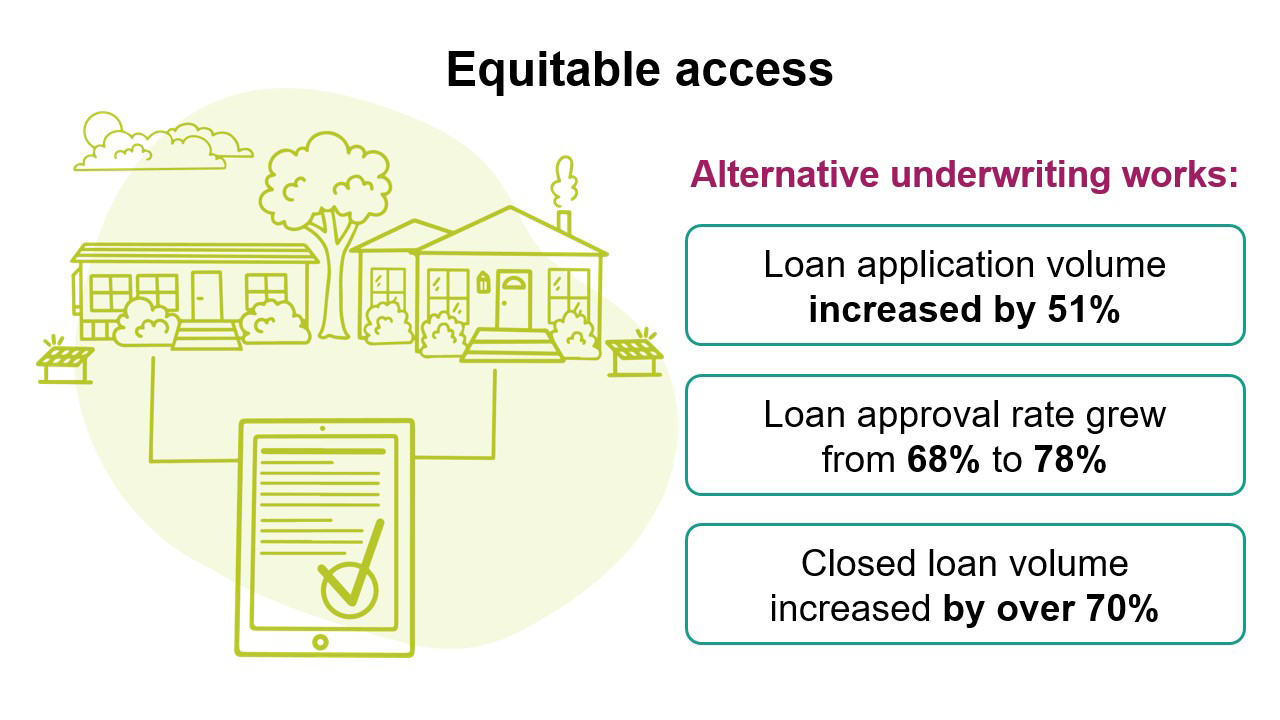

1. Who do you want to reach, and how can your program advance equity?

Inclusive underwriting approaches mean that more people can benefit from your program. Traditional underwriting practices consider debt-to-income ratio and credit scores, even though energy efficiency loans are extremely low risk.

Approaches that consider utility or housing payment history can improve loan application volume and approval rates. When we helped one of our partners implement alternative underwriting practices, they received over 50% more loan applications, grew their overall loan approval rate 10%, and they closed over 70% more loans.

2. What can you budget for startup costs?

Direct bill programs are generally quickest and cheapest to start up because they don't integrate with a utility billing system. On-bill programs have higher startup costs because they require integration with the utility's billing system, and they can garner higher participation because people value the simplicity of paying off an energy upgrade on their utility bill.

PAYS programs require specialized analytical tools, billing system integration, and recruiting a network of installation contractors, which further increases startup costs. However, the strong consumer protections and streamlined implementation process can improve participation.

3. How well do you understand the risk of energy efficiency loans?

Many people assume that any financing programs are risky endeavors. But research from Lawrence Berkeley National Lab finds that energy efficiency loans are very low risk, with annualized loss rates below 1%.

Tariffed on-bill and PAYS are subject to utility disconnection rules for nonpayment, which can make their risk even lower. EEtility, the organization who has administered the most PAYS programs nationwide, reports no disconnections to date from any of the programs they administer.

4. Should the loan stay with the person on the property?

Renters deserve important access to energy upgrades that can improve their health and save them money, but to improve the likelihood that renters participate the loans will need to be transferable across residents.

Direct bill loans aren’t generally transferable because the loan is tied to the individual, not the property. Some on-bill programs may allow transferring the repayment obligation to the next resident However, some states have different laws that may require loan payment in full rather than transfer, so you should consult the regulations in your state. TOB and PAYS models build transferability into the program, so the repayment obligation always stays with the property.

5. How will you bring a financing program to scale in your market?

Even the best energy financing program needs a vibrant market engagement strategy to drive participation.

Design your program with contractors in mind and prepare contractors to drive consumer awareness. Most importantly, make sure the system is easy to use and everything is at their fingertips to advocate for your product to their consumer.

Make sure your consumers needs are top of mind as well. A simple, easy-to-use, cloud-based system like Slipstream’s clean energy finance software VelocityGO responds to 30 years of energy finance program administration. Our tool brings the needs of consumers and contractors front and center — and gives you deep access to reports on your climate and equity impacts.

Slipstream's Energy Finance Solutions will help you determine which model will scale best in your market and how to best integrate financing with existing program offerings, all while empowering contractors and customers to make greener choices with fair financing.

6. What impact will the program have on energy bills?

PAYS programs require that monthly charges cannot exceed 80% of expected savings. TOB and On-bill programs have the potential to include a requirement like this should the program sponsor decide to do so. Direct bill programs are less likely to include this requirement because the financing mechanism is not directly tied to the utility bill.

That's a lot of information. What now?

Each model is an arrow in the finance quiver. Which one works best varies from market to market. Slipstream's Energy Finance Solutions is here to support you every step of the way to bring the right solutions to scale for your market. Get in touch to start designing you’re the right solutions for your community's needs.

Contact Claire Cowan to discuss which solutions to scale in your market.